No Products in the Cart

Blue Chip Supply Demand Trading Strategy is designed and tested extensively to provide traders easy to follow step by step guide for their trading journey.

You will find the detailed play book for this Trading Strategy below. Read the rules carefully to make sure you understand every trading rule for your trading success. As the market moves fast, you may not have enough time to refer this page while trading. Try to memorizing these rules, practice more and eventually you will be able to trade with your muscle memory.

Are you ready?

Before we get started, please understand this trading strategy is based on our 2 best trading indicators. You need to have the licenses to get started.

Open a new chart and apply following setup.

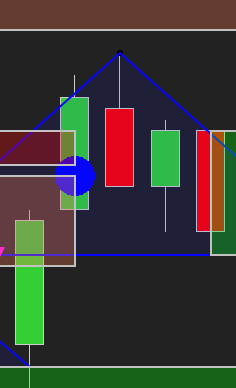

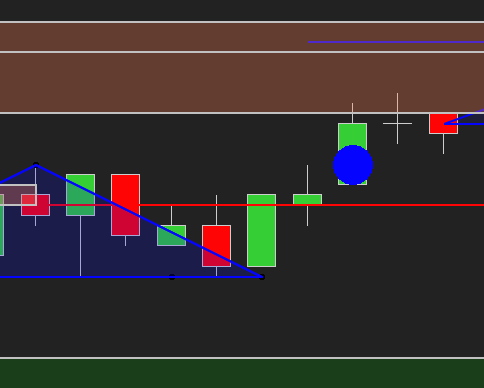

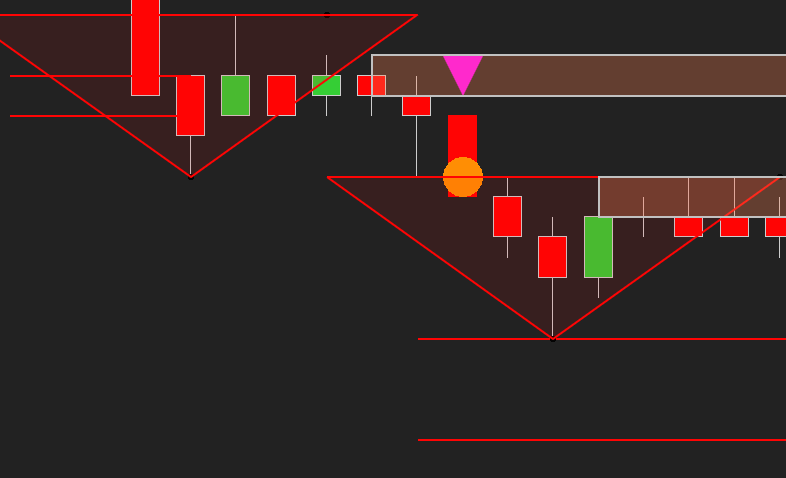

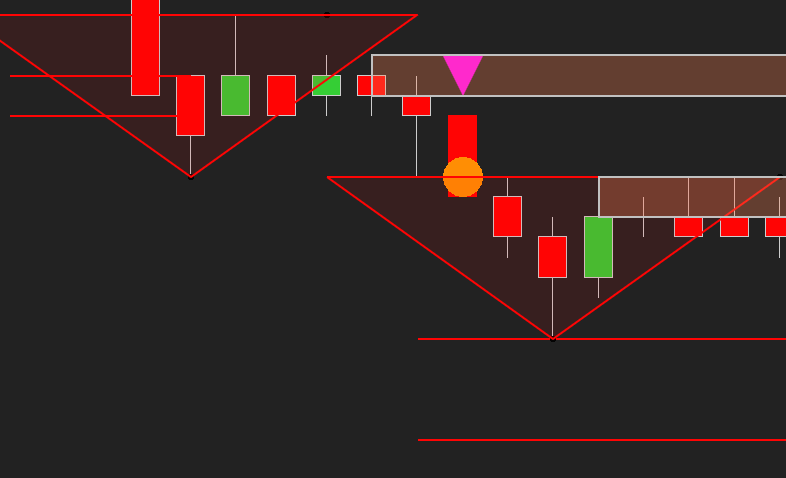

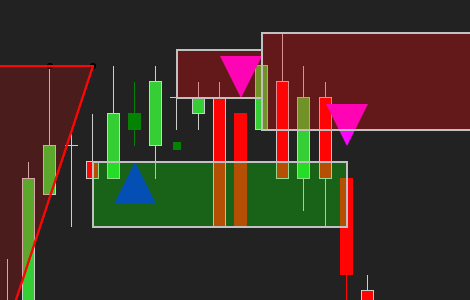

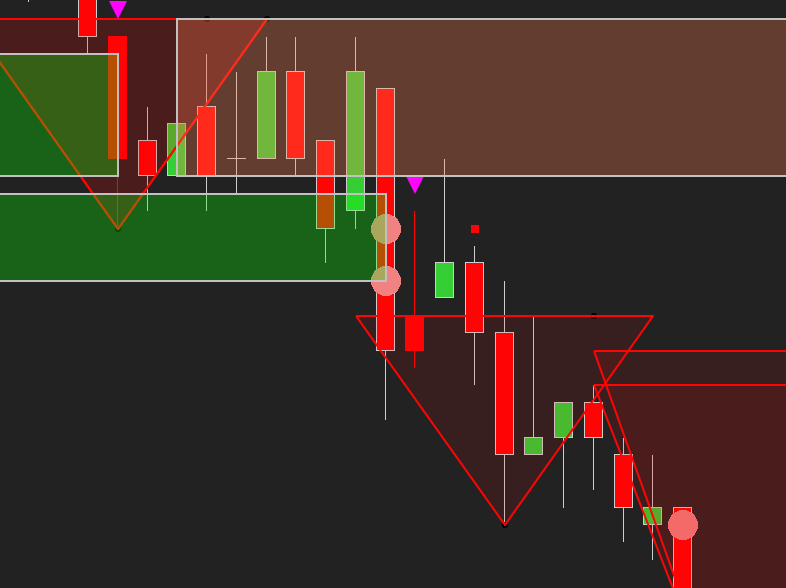

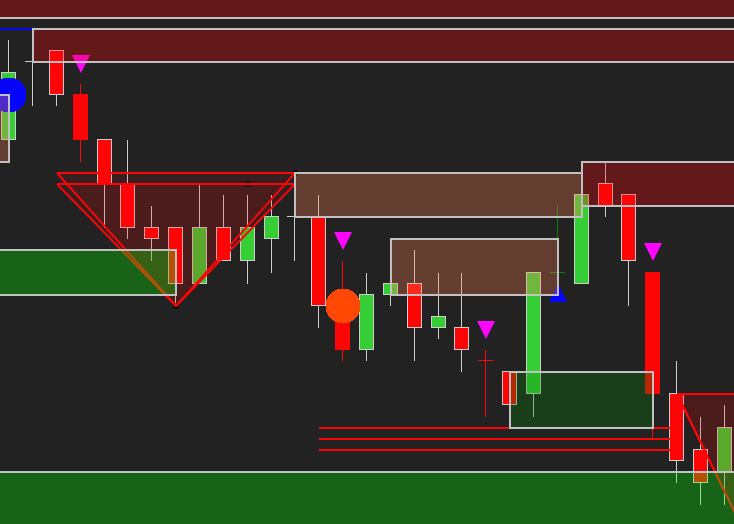

BG Blue Chip Indicator provides the long trade signal as blue circle dots and the short signals as red circle dots.

BG Supply Demand Indicator provides the long trade signal as blue up triangle and the short signals as pink down triangle.

Consider every trading signal and make sure all the following trading rules are satisfied before placing the trade.

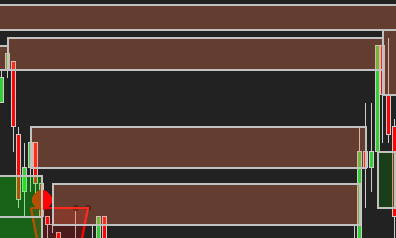

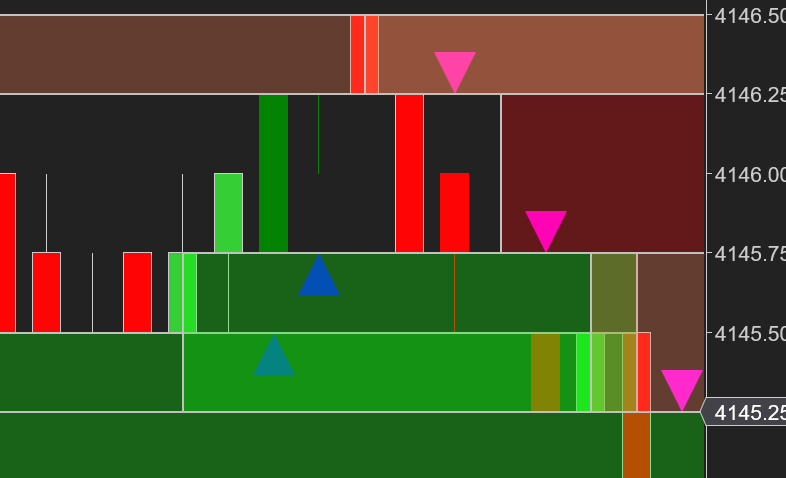

BG Supply Demand indicator provides real-time & historical support resistance in order flow data.

3a. The Red bars are resistance level.

3b. The Green bars are support level.

We will be updating this page frequently with any new changes in the trading strategy. Please check this page every few weeks to have up-to-date knowledge on this trading strategy.